Lending And Payments Market Competition Analysis 2025: How Players Are Shaping Growth

The Business Research Company’s Lending And Payments Global Market Report 2025 - Market Size, Trends, And Global Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, December 23, 2025 /EINPresswire.com/ -- The Lending And Payments market is dominated by a mix of global established financial institutions, fintech disruptors, and regional innovators. Companies are prioritizing seamless digital payment solutions, integrated lending platforms, and customer-centric innovations to enhance user experience and expand market reach. Understanding of the competitive landscape is essential for stakeholders aiming to identify growth opportunities, forge strategic partnerships, and drive technological adoption in a rapidly evolving financial ecosystem.

Which Market Player Is Leading the Lending And Payments Market?

According to our research, Industrial and Commercial Bank Of China Ltd. (IDCBY) led global sales in 2023 with a 2% market share. The Interest Income division of the company completely involved in the lending and payments market, provides broad range of lending and payment solutions, including personal loans, corporate financing, and mortgage services. It offers trade finance, syndicated loans, and structured credit to support businesses. The bank provides secure digital payments, treasury services, and cash management, ensuring efficient financial transactions for individuals and enterprises.

How Concentrated Is the Lending And Payments Market?

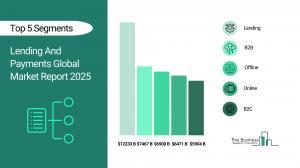

The market is fragmented, with the top 10 players accounting for 9% of total market revenue in 2023. This level of fragmentation underscores the market’s competitive intensity and diversity, driven by regional regulations, local banking ecosystems, and varied technological adoption across economies. Major institutions such as the Industrial and Commercial Bank of China, Agricultural Bank of China, Citi, and Bank of America maintain leadership through their extensive global networks, capital strength, and integrated digital payment infrastructures. However, the dominance of these players is diluted by a vast number of regional banks, fintechs, and specialized payment providers catering to localized or sector-specific needs. As digital transformation and open banking frameworks continue to expand, the market is expected to experience increased collaboration and strategic alliances, gradually enhancing scale efficiencies among leading institutions.

• Leading companies include:

o Industrial and Commercial Bank Of China Ltd. (IDCBY) (2%)

o Agricultural Bank of China (1%)

o Citi Group Inc (1%)

o Bank of America (BoA) Corp (1%)

o HSBC Holdings plc (1%)

o China Construction Bank Corporation (1%)

o BNP Paribas (1%)

o Goldman Sachs Group Inc (1%)

o Wells Fargo & Co (0.5%)

o Mitsubishi UFJ Financial Group (0.4%)

Request a free sample of the Invoice Factoring Market report

https://www.thebusinessresearchcompany.com/sample_request?id=1886&type=smp

Which Companies Are Leading Across Different Regions?

•North America: Adyen N.V, Tata Consultancy Services Limited (TCS), Accord Financial Corp, PSP Services Inc, NCR Atleos Inc, Nuvei Corporation, Fidelity National Information Services, Inc. (FIS), PingPong Payments Ltd, JPMorgan Chase & Co, Citigroup Inc, Bank of America Corporation, U.S. Bancorp (US Bank), Jenius Bank, Tavant Technologies Inc, The Goldman Sachs Group, Inc, Wells Fargo & Company, American Express Company, Bank of Montreal (BMO Financial Group), Royal Bank of Canada (RBC), Dealnet Capital Corporation, Industrial and Commercial Bank of China Limited (ICBC), and First Citizens BancShares, Inc are leading companies in this region.

• Asia Pacific: Bendigo and Adelaide Bank Limited, The People’s Bank of China, Reserve Bank of India, Oriental Corporation, Industrial and Commercial Bank of China (Asia) Limited, Agricultural Bank of China, Bank of China Limited, Webcash Global Co, Ltd, Zeller Pty Ltd, Lendingkart Technologies Pvt. Ltd, Citigroup Inc, WeLab Holdings Limited, J.P. Morgan Securities (Asia Pacific) Limited, Hong Kong Monetary Authority, PhonePe Private Limited, State Bank of India, Axis Bank Limited, Mahindra & Mahindra Financial Services Limited, Paytm Payments Bank Limited, IndusInd Bank Limited, Federal Bank Limited, Change Financial Limited, Kona I Co, Ltd, Afterpay Limited, Tyro Payments Limited, POLi Payments Pty Ltd, DBS Bank Ltd, Punjab National Bank, Axis Bank Limited, HDFC Bank Limited, ICICI Bank Limited, Canara Bank, Union Bank of India, Indian Overseas Bank, Central Bank of India, Kotak Mahindra Bank Limited, Bank of Maharashtra, Sony Bank Inc, Rakuten Group Inc, PayPay Corporation, Kakao Pay Corporation, JCB Co, Ltd, Komoju Inc, PayPay Corporation, China Construction Bank Corporation, Postal Savings Bank of China Co, Ltd, Industrial and Commercial Bank of China Limited, Lenditt Limited, Woori Bank Vietnam Limited, ICBC Financial Leasing Co, Ltd, UnionPay International Co, Ltd, HSBC Financial Services Fund, Salesforce, Hitachi Payment Services Private Limited, and Woori Financial Group Inc are leading companies in this region.

• Western Europe: Crédit Agricole Group, Worldline SA, Deutsche Bank AG, Tink AB, Conferma Limited, Interactive Transaction Solutions (ITS) Limited, Commerzbank AG, Bling Card, GLS Bank eG, PAYA Group LLC, Klarna Bank AB, Adyen N.V, CaixaBank, S.A, M&S Bank plc, Sainsbury's Bank plc, Barclaycard, Brite Payments AB, Aqua Financial Services Ltd, TF Bank AB, Advanzia Bank S.A, PayPal Holdings, Inc, Worldpay, Inc, Ribbon Plc, Conferma Pay Limited, Adyen N.V, Mambu GmbH, Ibercaja Banco, S.A, Finom GmbH, Lydia Solutions SAS, Fneek Inc, British Business Bank plc, HSBC Holdings plc, BNP Paribas SA, Lloyds Banking Group plc, Barclays plc, The Royal Bank of Scotland Group plc, Standard Chartered PLC, UniCredit S.p.A, NRW.Bank, Norddeutsche Landesbank Girozentrale, and Midas Corporación Financiera S.A. (Spain) are leading companies in this region.

• Eastern Europe: Tinkoff Bank, Sberbank of Russia, Yandex.Money (now YooMoney), PayPal Holdings, Inc, Dotpay Sp. z o.o, Przelewy24 (P24) by Blue Media S.A, Tap2Pay, eCard S.A, Transferuj.pl Sp. z o.o, MONETA Money Bank, a.s, UniCredit S.p.A, Santander Bank Polska S.A, Black Sea Trade and Development Bank (BSTDB), ING Bank N.V. Romania Branch, JPMorgan Chase & Co, Citigroup Inc, European Investment Bank (EIB), Mitsubishi UFJ Financial Group, Inc, Transfond JSC, BNP Paribas S.A, and Raiffeisenbank a.s are leading companies in this region.

• South America: PayAmigo, PagBrasil Tecnologia em Meios de Pagamento Ltda, PayRetailers S.A, Fintech Unicorn, Clara Labs Inc, CAF – Development Bank of Latin America and the Caribbean, Inter-American Development Bank (IDB), Multilateral Investment Guarantee Agency (MIGA), Banco Nacional de Desenvolvimento Econômico e Social (BNDES), Dock Tech S.A, Banco de la Nación Argentina, Banco Macro S.A, Banco Galicia y Buenos Aires S.A, Banco Bilbao Vizcaya Argentaria (BBVA) Argentina, Banco do Brasil S.A, Banco Bradesco S.A, Banco Santander Brasil S.A, Banco de Chile, Scotiabank Chile S.A, Bancolombia S.A, Banco de Bogotá S.A, Banco Davivienda S.A, and Mibanco S.A. are leading companies in this region.

What Are the Major Competitive Trends in the Market?

•Revolutionizing Lending With Seamless Embedded Finance Solutions is transforming to streamline the borrowing process and offer more personalized financial services to their customers.

• Example: Unit Finance Inc white-label app (November 2023) assigns to enable software companies to easily integrate branded banking and lending services into their platforms

• These innovations provide full suite of financial tools such as deposit accounts, card management, payments, and lending, all while ensuring security and compliance

Which Strategies Are Companies Adopting to Stay Ahead?

•Expanding partnerships with fintechs and banks to broaden service offerings and customer reach

• Investing in advanced data analytics and machine learning to improve credit risk assessment and fraud detection

• Enhancing mobile and digital payment solutions to drive user convenience and engagement

• Strengthening regulatory compliance and cybersecurity frameworks to build customer trust and ensure operational resilience

Access the detailed Lending And Payments Market report here:

https://www.thebusinessresearchcompany.com/report/lending-and-payments-global-market-report

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.