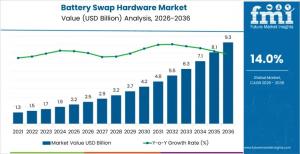

Global Battery Swap Hardware Demand is Projected to Grow USD 9.3 Billion by 2036, Driven by fleet-led electrification

Sale of battery swap hardware in Germany is growing at a 13.6% CAGR (2026–2036), driven by premium automotive, industrial fleets, and strict safety standards.

NEWARK, DE, UNITED STATES, January 16, 2026 /EINPresswire.com/ -- The battery swap hardware market is entering a decade of structurally driven growth as electric mobility operators prioritize vehicle uptime, predictable energy replenishment, and scalable infrastructure over conventional charging models. Between 2026 and 2036, demand is expected to expand across Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa, with adoption concentrated in two- and three-wheelers, shared mobility fleets, taxis, and last-mile delivery operations.

Unlike consumer-driven EV sales, battery swap hardware demand is shaped by fleet density, standardized battery formats, and repeatable swap cycles. These applications require frequent daily vehicle utilization, where charging downtime directly impacts operating economics. As a result, the market’s performance depends less on headline EV penetration and more on how consistently swap stations are utilized across locations.

Growth is strongest where battery form factors are standardized and supported by ecosystem partnerships among OEMs, energy providers, and fleet operators. Conversely, fragmented vehicle platforms and underutilized infrastructure introduce volatility into hardware orders and weaken long-term project economics.

Discover Growth Opportunities in the Market – Get Your Sample Report Now

https://www.futuremarketinsights.com/reports/sample/rep-gb-31447

Quick Stats: Battery Swap Hardware Market

• Market value (2026): USD 2.5 billion

• Forecast value (2036): USD 9.3 billion

• Forecast CAGR (2026–2036): 14.0%

• Leading station type: Robotic auto-swap stations (48% share)

• Key regions: Asia Pacific, Europe, North America, Latin America, Middle East & Africa

Key Drivers: Fleet Uptime and Infrastructure Standardization

Battery swap hardware adoption is accelerating as EV operators seek to decouple vehicle utilization from grid charging constraints. Automated swap stations, robotic handling systems, and modular battery racks allow fleets to exchange depleted batteries for fully charged units within minutes, supporting round-the-clock operation.

Procurement decisions increasingly favor hardware platforms that support standardized battery form factors, automated authentication, and integration with fleet management and billing systems. Vendors that align mechanical design with battery management systems and software platforms are gaining preferred status in multi-city deployments.

Deployment economics also play a central role. Swap stations are evaluated on installation footprint, throughput capacity, maintenance intervals, and total cost per swap. Energy companies and infrastructure investors are partnering with hardware suppliers to roll out dense networks, particularly in urban Asia and emerging markets.

Market Structure: Station Type and Hardware Scope

The battery swap hardware market is segmented by station type and hardware scope:

By station type:

• Robotic auto-swap stations

• Manual or assisted swap bays

• Battery cabinet systems for two- and three-wheelers

Robotic auto-swap stations account for 48% of the market due to their ability to deliver rapid, repeatable battery exchange with minimal human intervention. Automation improves swap speed, reduces handling risk, and enables higher throughput without proportional labor increases.

By hardware scope:

• Swap mechanism and robotics

• Battery storage and BMS racks

• Power electronics and chargers

• Site infrastructure and auxiliary hardware

Swap mechanisms and robotics represent approximately 40% of hardware value, reflecting their role as the functional core of automated swapping operations. These systems must withstand high cycle frequencies, varying battery weights, and outdoor operating conditions, making reliability and mechanical precision critical purchasing factors.

Regional and Country-Level Outlook

Growth varies significantly by country, reflecting differences in EV fleet density, standardization efforts, and infrastructure investment.

Battery Swap Hardware Market CAGR by Country (2026–2036):

• China: 15.2%

• Brazil: 14.8%

• United States: 13.7%

• Germany: 13.6%

• South Korea: 13.2%

China leads global demand due to large-scale deployment of battery swapping across two-wheelers, taxis, and commercial fleets, supported by standardized battery architectures and dense urban networks. Brazil is emerging as a high-growth market as swapping addresses charging infrastructure gaps for delivery and urban mobility fleets.

In the United States and Germany, adoption is largely pilot-led, focused on commercial fleets and controlled environments where reliability, safety certification, and engineering precision are prioritized over rapid rollout. South Korea’s market is shaped by close integration between EV manufacturers, battery producers, and robotics providers, emphasizing compact, high-performance hardware designs.

Checkout Now to Access Competitive Analysis:

https://www.futuremarketinsights.com/checkout/31447

Competitive Landscape: Hardware-Centric Differentiation

Competition in the battery swap hardware market is defined by swap speed, mechanical reliability, standardization depth, and integration with vehicle and energy ecosystems.

Key players include:

• NIO Power

• Gogoro

• SUN Mobility

• Ample

• Aulton

• CATL EVOGO (hardware)

• KYMCO Ionex

• BAIC BluePark

• Hero–Ather operators

• Hyundai–Kia pilot programs

Premium players focus on fully automated, high-throughput stations, while emerging suppliers compete on modularity, adaptability, and cost-efficient designs. OEM-backed ecosystems strengthen positioning through vertical integration and proprietary battery platforms.

Market Outlook

From 2026 to 2036, the battery swap hardware market is expected to evolve as a critical enabler of high-utilization electric mobility ecosystems. Long-term revenue stability will depend on infrastructure utilization discipline, standardization progress, and the ability of hardware platforms to scale reliably across fleets and geographies. As fleet electrification accelerates, battery swap hardware is positioned not as a complementary solution, but as a core component of commercial EV operations worldwide.

Why FMI: https://www.futuremarketinsights.com/why-fmi

Related Insights from Future Market Insights (FMI)

Crossover Market

https://www.futuremarketinsights.com/reports/crossover-market

Automotive Junction Box Market

https://www.futuremarketinsights.com/reports/automotive-junction-box-market

Remote Vehicle Diagnostics Market

https://www.futuremarketinsights.com/reports/remote-vehicle-diagnostics-market

Electric Vehicle Test Equipment Market

https://www.futuremarketinsights.com/reports/electric-vehicle-test-equipment-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.